Blogs

The Bollywood Guide to Finance: Is Your Portfolio a ‘Dhurandhar’ or a ‘Hungama’?

Mr. Pratik Kodmalwar

Faculty of Finance

Datta Meghe Institute of Management Studies

The Bollywood Guide to Finance: Is Your Portfolio a ‘Dhurandhar’ or a ‘Hungama’?

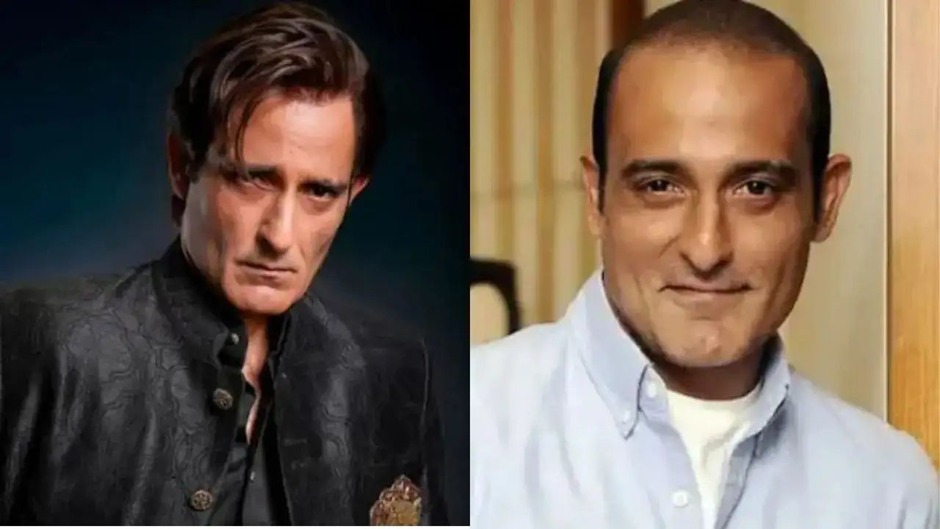

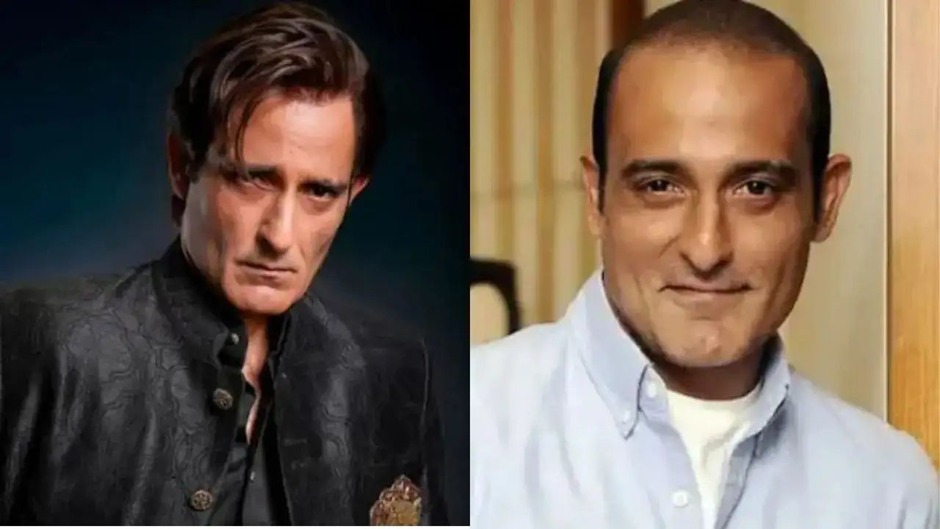

If you grew up watching Hindi cinema in the early 2000s, you know that Akshaye Khanna is a man of two legendary extremes. On one hand, you have the slick, sharp-suited, and dangerously confident Rehman Dakait from Race. On the other, you have the earnest, slightly chaotic, but gold-hearted Jitu from Hungama.

Faculty of Finance

Datta Meghe Institute of Management Studies

The Bollywood Guide to Finance: Is Your Portfolio a ‘Dhurandhar’ or a ‘Hungama’?

If you grew up watching Hindi cinema in the early 2000s, you know that Akshaye Khanna is a man of two legendary extremes. On one hand, you have the slick, sharp-suited, and dangerously confident Rehman Dakait from Race. On the other, you have the earnest, slightly chaotic, but gold-hearted Jitu from Hungama.

Believe it or not, these two characters perfectly explain the biggest debate in corporate finance: EBITDA vs. Cash Flow.

The Rehman Dakait of Finance: EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the Rehman Dakait of your Profit & Loss statement.

The Swag: It looks incredible on a PowerPoint slide. It’s loud, it’s stylish, and it screams “dominance.”

The Vibe: It tells you how much the business could make if the world were perfect—ignoring the “boring” stuff like debt payments or the fact that your machinery is wearing out.

The Risk: Just like you wouldn’t trust Rehman with your wallet despite his expensive suit, you can’t always trust EBITDA. It’s often a “half-truth” delivered with full confidence. Markets admire the swag, but it can be misleading.

The Jitu (Videocon) of Finance: Cash Flow

Then comes the Cash Flow Statement—the Jitu from Hungama.

The Swag: Zero. It’s unsexy, it’s simple, and it doesn’t use fancy filters or “adjustments.”

The Vibe: It doesn’t care about “projections” or “accruals.” It only cares about the honest truth: Is the money actually in the bank?

The Trust: Jitu is the guy you’d hand your money to without thinking twice. He might be “boring” compared to a Dhurandhar, but when the bills come due, Jitu is the one who actually has the cash to pay them.

The Reality Check In the world of investing, it’s easy to be charmed by the Rehman Dakait energy of a company—the high-growth, high-EBITDA stories that dominate pitch decks. But when loans, salaries, and dividends are due… Style doesn’t pay. Cash does.

Finance Rule: If a company talks like Rehman Dakait in its PPTs, make sure it behaves like Jitu in its Cash Flow Statement.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the Rehman Dakait of your Profit & Loss statement.

The Reality Check In the world of investing, it’s easy to be charmed by the Rehman Dakait energy of a company—the high-growth, high-EBITDA stories that dominate pitch decks. But when loans, salaries, and dividends are due… Style doesn’t pay. Cash does.

Finance Rule: If a company talks like Rehman Dakait in its PPTs, make sure it behaves like Jitu in its Cash Flow Statement.